How Does the New Tax Bill Affect Families That Make 50000

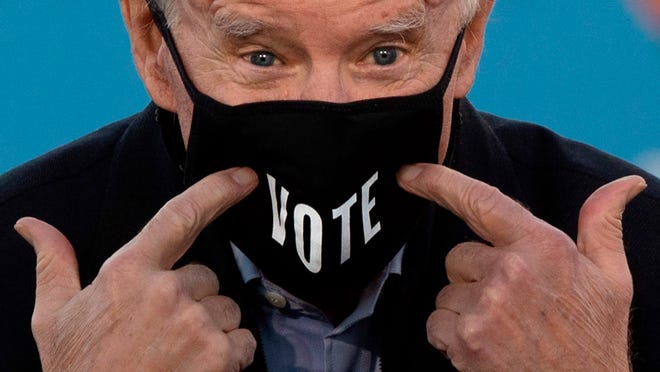

The claim: Biden's and Harris' tax plans would raise rates on a family unit making $75,000 or $3,000 biweekly

Viral posts on Facebook claim tax rates for some families would more double if Democrat Joe Biden is elected president.

"Bidens tax rate on a family making 75000 dollars would get from 12% to 25%," reads a postal service Aug. 16 that has been shared more than than 126,000 times. "Allow THAT SINK IN ALL You lot RIDING WITH BIDEN SUPPORTERS."

Other Facebook users shared like versions of the manifestly text meme that gained hundreds of shares. The claim made its way to Twitter.

Fact or fiction:We'll fact check the news and transport updates right to your inbox. Sign up to get them here.

Another meme centered on the proposed taxation policies of Biden's running mate, Sen. Kamala Harris, D-Calif., made the rounds on Facebook this calendar month. A post Aug. 23 to Aaron Hughes' Facebook page that went viral features a screenshot from a Fox Concern Network segment of Harris' proposed economic policies, pitched during her campaign for president.

Above the screenshot is a statement addressing Harris' suggested income revenue enhancement increase to 39.6% for summit earners.

"Say your bi-weekly gross bacon is $3,000 yous are giving these distressing sacks 39.6% which is $i,188. Nearly Half YOUR PAYCHECK!!! Forget feeding your family subsequently you've paid all your bills! Are you Really okay with this???" the statement reads.

The meme was posted to the Facebook page for Project Republic later the same twenty-four hours. Projection Republic is a media company that supports President Donald Trump, according to its Twitter bio.

USA TODAY reached out to the users for annotate. Hughes did non offer additional data about his post in a response.

Taxes would not double, analyses testify

A federal revenue enhancement charge per unit of 12% applies to families that make upwards to $fourscore,250 or individuals who brand up to $40,125, according to the Internal Revenue Service. Although posts merits this rate would increase, tax rates for families earning $75,000 annually would stay the aforementioned under Biden's plan.

Garrett Watson, senior policy analyst at the Tax Foundation, told U.s. TODAY via email that the claim uses the 12% income tax bracket nether current constabulary, which ranges from $xix,750-$80,250 in taxable income for those filing jointly.

The posts claim the tax charge per unit would return to where it was before the Tax Cuts and Jobs Act, which was 25% for articulation filers who earned $75,900 to $153,100 in taxable income for 2017, Watson said.

"Biden has stated that he would repeal the individual tax cuts for those earning $400,000," Watson said. "While he has not explicitly stated that he would support extending the remaining TCJA rates, when they expire at the end of 2025, it is wrong to say that raising those rates is part of his revenue enhancement proposals at this time."

Watson said that even if Biden's proposal included a full repeal of TCJA rates, the claims wouldn't exist right.

"A joint filer earning $75,000 in taxable income would be in the fifteen% tax bracket, not the 25% bracket. For unmarried individuals earning $75K, full TCJA repeal would hateful going from a 22% top marginal revenue enhancement rate now to a 25% rate," Watson said.

A single taxpayer making $3,000 every two weeks – as described in the Harris merits – earns $78,000 a year. People in this income bracket would not give up "half their paychecks" under the Democrats' proposed revenue enhancement program.

Biden'south plan raises taxes for high-income individuals, corporations

Similar analyses of Biden's tax plan notation that corporate tax rates would increase.

"Biden would enhance the corporate tax rate from 21 to 28 percentage," the Committee for a Responsible Federal Upkeep estimated, and his tax program would enhance somewhere betwixt $3.35 trillion to $3.67 trillion over a decade if enacted in full starting in 2021.

Based on information released by the Biden campaign and conversations with its staff, the Taxation Policy Center found that "loftier-income taxpayers would face increased income and payroll taxes."

The summit tax rate is 37% for individual single taxpayers with incomes greater than $518,400 and $622,050 for married couples filing jointly, according to the IRS.

The Tax Foundation and the Committee for a Responsible Federal Upkeep said Harris and Biden proposed raising the top marginal income revenue enhancement rate to 39.6%.

The screenshot from Fox Business organisation Network accurately says Harris proposed raising the corporate income tax rate from 21% to 35% and imposing a 0.2% financial tax rate on stock trades and a 0.1% rate on bond trades equally a candidate, according to the Taxation Foundation.

Details near the "4% extra revenue enhancement on $100K+ households" were not included. Per The Tax Foundation, Harris floated a 4% income-based insurance premium on households making more than than $100,000 a yr to fund her "Medicare for All" plan.

Biden said 'no new taxes' would exist raised on anyone making less than $400,000

The onetime vice president has said a tax increase for those making less than $400,000 is not a part of his programme.

In a articulation interview with Harris, Biden told ABC News, "I will raise taxes for anybody making over $400,000," and anyone making less than that would face "no new taxes."

In an interview with CNBC in May, Biden said, "Nobody making under 400,000 bucks will take their tax raised. Period."

The Washington Postal service reported in May on Biden'southward announcement that he is firm on not raising taxes on the middle class.

The Biden campaign could not be reached for comment. Campaign spokesman Michael Gwin told Reuters that Biden has fabricated clear that no one making less than $400,00 would see their taxes raised.

"Moreover, Biden will requite millions of centre-class families a revenue enhancement cut through new refundable credits that lower the cost of health insurance, assistance kickoff-fourth dimension homebuyers buy a house and assist working families to pay for kid care," Gwin said.

Our ruling: False

This merits is Simulated, based on our enquiry. Biden said he will non raise taxes on anyone making less than $400,000 a year. A taxpayer making $75,000, or making $3,000 biweekly, would not motion to a higher tax bracket, equally claimed. Analysts concluded that Biden's tax plan would apply to wealthy individuals and corporations.

Our fact-cheque sources:

- Internal Revenue Service: IRS provides tax inflation adjustments for tax year 2020

- Revenue enhancement Foundation, Nov. 14: 2019, 2020 Tax Brackets

- Tax Foundation Fiscal Fact: November 2016, 2017 Tax Brackets

- Garrett Watson: Email argument to U.s. TODAY

- Committee for a Responsible Federal Budget, July xxx: Understanding Joe Biden's 2020 Tax Plan

- Taxation Policy Center, March 5: An Assay of Former Vice President Biden'southward Tax Proposals

- CNBC Transcript, May 22: Former Vice President Joe Biden Speaks with CNBC's "Squawk Box" Today

- The Washington Post, May 22: Joe Biden says he won't enhance taxes on anyone making under $400,000

- Reuters, Aug. 19, Fact check: Joe Biden has not proposed a revenue enhancement hike on families making $75,000 a yr

- Internal Revenue Service, November. half dozen, 2019: "IRS provides tax inflation adjustments for taxation yr 2020"

- The Tax Foundation, Aug. 12, 2020: "Where Does Kamala Harris Stand up on Tax Policy?"

- ABC News, Aug. 23: Biden to ABC'due south David Muir on raising taxes: 'No new taxes' for anyone making less than $400,000

Thank y'all for supporting our journalism. You tin can subscribe to our print edition, advertizing-gratuitous app or electronic paper replica here.

Our fact cheque work is supported in part by a grant from Facebook.

This fact cheque is bachelor at IFCN's 2020 US Elections FactChat #Chatbot on WhatsApp. Click hither, for more.

Source: https://www.usatoday.com/story/news/factcheck/2020/08/30/fact-check-biden-tax-plan-raises-rates-those-who-make-over-400-k/3418926001/

0 Response to "How Does the New Tax Bill Affect Families That Make 50000"

Post a Comment